FORECAST

Have greater confidence in your due diligence with FORECAST.

Property tax surprises will never threaten the success of your projects when your due diligence includes a FORECAST tax projection. With expert interpretation of quality data, our on-demand real estate tax projections support due diligence for any property, any deal type, anywhere in the United States.

Every FORECAST Tax Projection includes:

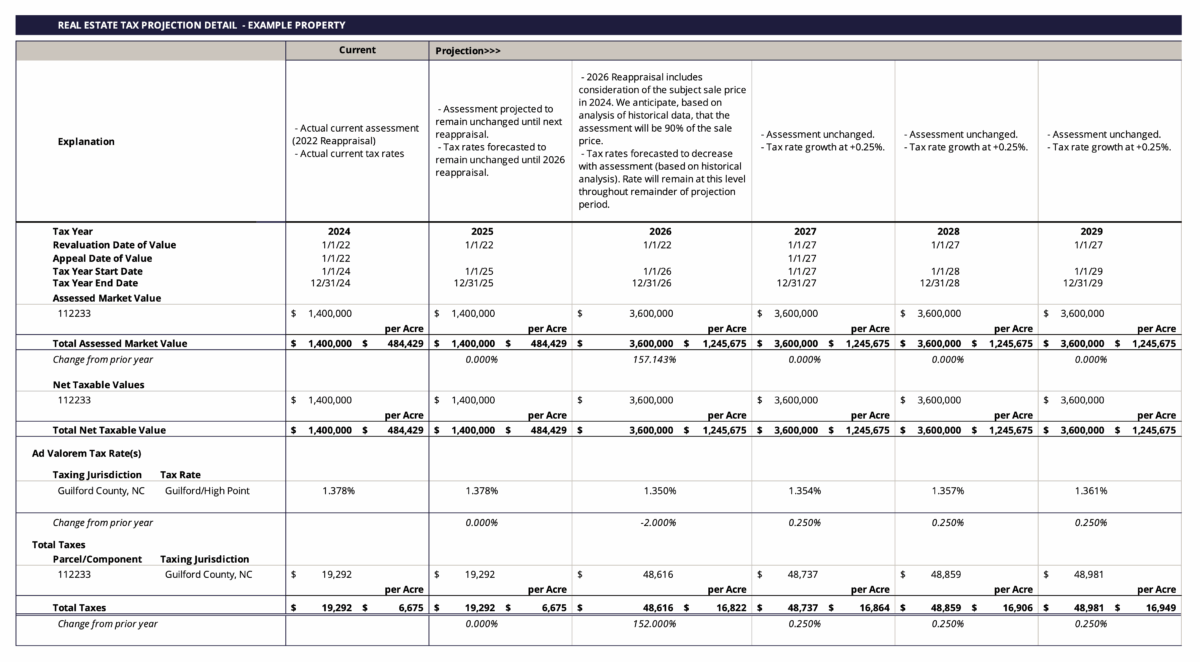

Jurisdiction insights that clearly explain how, why, and when your property will be assessed and taxed based on your specific deal type.

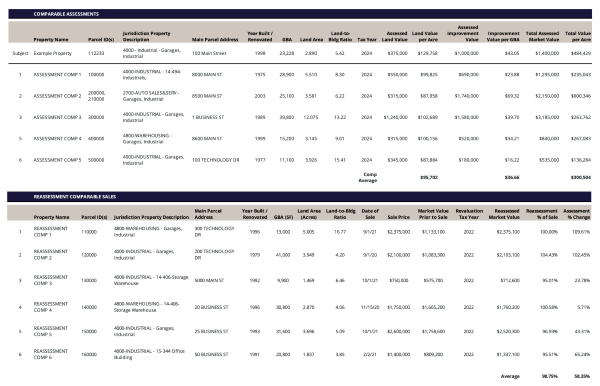

Assessment comparables that illustrate how similar properties with similar deal characteristics have been treated by the taxing jurisdiction.

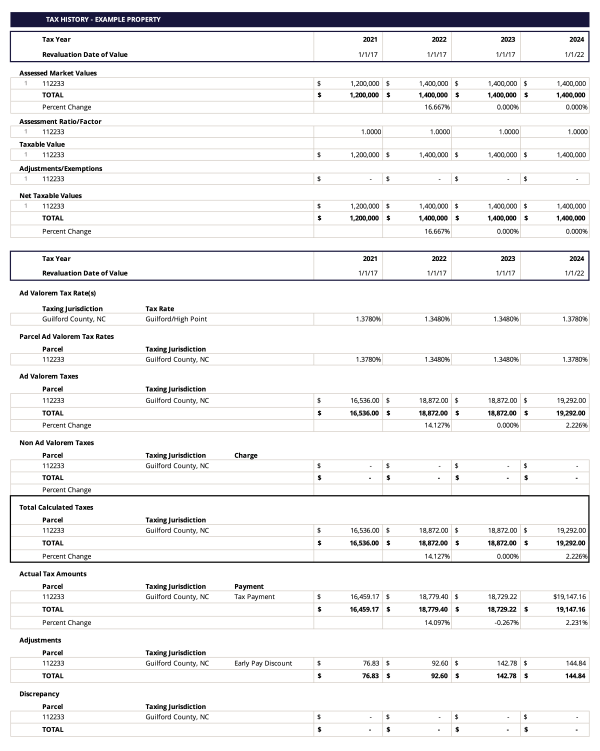

A comprehensive real estate tax forecast that accurately quantifies annual real estate tax expenses through the entire life cycle of your specific deal; developed with proprietary Taxonics technology and reviewed by our tax experts.

Every FORECAST Tax Projection is:

In Excel for easy sharing and collaboration

Completed by real estate tax experts

Built using the Taxonics data platform, INFORM

PRICED FOR YOUR SCENARIO

FORECAST is priced per projection. Volume pricing is available for enterprise packages.

Acquisition

When you’re acquiring a property $1,750

- 5-Year projection period

- Relevant comp analysis

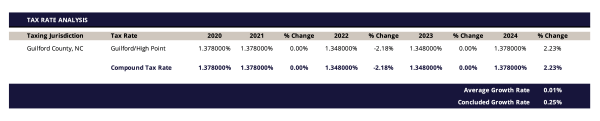

- Tax rate analysis

- Value growth analysis

Development

When you’re developing a property $4,375

- Projection period based on your development

- Relevant comp analysis

- Tax rate analysis

- Value growth analysis

- Recreated tax history

- New construction analysis

- Supplemental/demolition pickup analysis

- Parcel reorientation analysis

“We identified an acquisition opportunity in a new market and tax jurisdiction. Taxonics removed any uncertainty surrounding potential tax implications through their comprehensive real estate tax due diligence, despite jurisdictional complexities.”

Jeff Schaeffer

Alterra Property Group

“With Taxonics’ due diligence tools, we were able to clearly define the tax picture for our multi-phase, mixed-use development in the Northeast. Through this detailed analysis, we were able to put our partners minds at ease identifying exactly what the development’s taxes would be during each phase of the build.”

Brandon Segal

Hines

“Real estate taxes are a critical component of our underwriting due to its significant impact on valuation and cash flow, yet we only have so much time to gather precise and detailed tax data to help us make sound assumptions. INFORM and it’s Acquisition Underwriting has become our primary source for timely and reliable information.”

Tong Li

LCOR